As oil prices decline, the Organization of Petroleum Exporting Countries has decided not to cut oil production.

OPEC’s production decision is not a new one. And the group of oil-producing nations could very well announce a cut in oil supply in the future if oil prices continue to fall. Either way, the price impact from OPEC’s decision would likely be marginal.

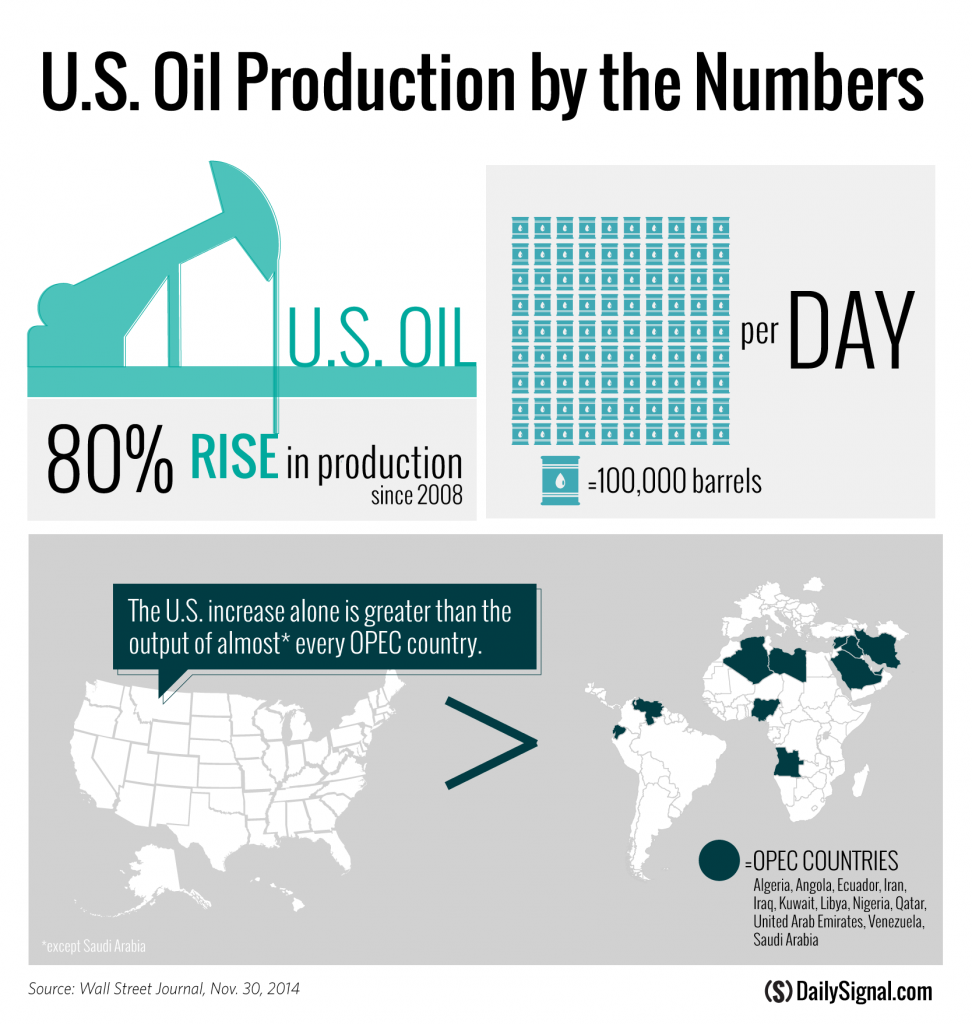

After all, oil is a globally traded commodity and its prices are affected by many factors. OPEC is undoubtedly a big player in that market, but the United States, Canada and other countries are becoming increasingly large players.

Why OPEC Isn’t a Cartel

Newspapers and several pundits are hailing OPEC’s pronouncement as a fundamental shift in global oil markets. But it’s not. The reality is OPEC is not, nor was it ever, the market manipulator many perceive it to be.

OPEC is largely unable to restrict supplies and control oil prices because its members have a strong incentive to cheat and increase oil production above their quotas.

OPEC is often labeled a cartel and the perception is that there are a small number of oil producers that can manipulate supply enough to affect the price and few substitutes exist. Yet OPEC does not necessarily act like a cartel, nor has it ever been particularly effective in restricting oil supplies.

In fact, OPEC is largely unable to restrict supplies and control oil prices because its members have a strong incentive to cheat and increase oil production above their quotas. As American University professor of international relations Jeff Colgan writes, “A cartel needs to set tough goals and meet them; OPEC sets easy goals and fails to meet even those.”

Will O’Keefe, president of the George Marshall Institute, writes that OPEC does not hold many of the characteristics of a cartel. In his paper dispelling many of the myths of OPEC, O’Keefe notes that “There are a large number of oil-producing countries, there are not significant barriers to entry and history has shown that OPEC cannot easily alter supply to affect price.”

Michael Levi with the Council on Foreign Relations reminds us of a similar situation after prices began to fall in 2008:

After oil prices peaked at $145 per barrel in July 2008, they fell rapidly. On Sept. 10, with the oil price at $96, OPEC declared a production cut, only for Saudi Arabia to announce within hours that it would ignore the agreement, rendering it meaningless. Indeed, according to International Energy Agency data, Kuwait, Angola, Iran and Libya all expanded production in October of that year, while Saudi Arabia pared back output by a mere 50,000 barrels a day. Prices continued to fall. It took until an emergency meeting on Oct. 25, with prices at $60, for OPEC to announce a real cut – and even that was not commensurate with the shortfall in global demand, leading prices to drop further. It was only in late December, as oil fell through the $40 mark, that OPEC countries finally cut production enough to put a floor on oil prices.

The Effects of an OPEC Oil Production Restriction

Saudi Arabia did have some influence over the market in the beginning of 2008 through its control of spare capacity. Global spare capacity also influences how quickly and significantly prices change. The Energy Information Administration defines spare capacity as the amount of oil that can be brought on the market within 30 days and sustained for 90 days. When oil markets are tight and have low spare capacity, the producers have less ability to respond and therefore prices can increase rather quickly.

The most effective tool to make energy just another commodity and undermine its strategic value is to have open markets developed through free trade and free enterprise.

If OPEC members were to restrict supply as U.S. production supplants OPEC supplies, global spare capacity would grow and provide a welcome cushion against any future disruptions. In fact, we’ve seen this cushion even without OPEC cutting production. Surging U.S. and Canadian production and relatively weak demand have eased market concerns despite potential supply disruptions and continued unrest in the Middle East.

What the U.S. Can Do to Minimize OPEC’s Effectiveness

Currently, energy is not just another commodity and does have strategic value in that certain countries or groups may derive power from controlling energy interests. We see that with Russia’s dominance in the natural gas market. The perceived threat of OPEC and the real threat of Russia have led to bad policy decisions in the past, whether it may be mandating the use of biofuels or using taxpayer dollars to subsidize alternative vehicle technology.

The most effective tool to make energy just another commodity and undermine its strategic value is to have open markets developed through free trade and free enterprise. Opening markets would provide a diversity of suppliers and greater energy supplies for the global market. This likely would result in lower prices and certainly will mean more choice for countries like Ukraine and the rest of Europe in the not-so-distant future. Ultimately, providing that choice and abundant diverse suppliers would minimize OPEC’s effectiveness in controlling markets and significantly diminish Russia’s use of energy for influence.

The American oil and gas industry is playing an important role in global energy markets with its dramatic growth in energy production. But government-imposed restrictions are reducing its ability to export natural gas and crude oil. Congress should act now to liberalize our energy markets and allow companies to freely trade the energy resources they produce. Providing more choices to both producers and consumers will generate jobs, grow the economy and bolster U.S. national security by increasing global energy supplies and reducing the ability for any single nation or group of actors to manipulate energy markets for political purposes.